Either US government officials do not know anything about economics

or they do not care to hire Economists to show them the facts

and their foreseable consequences.

It was reported today that the US budget deficit this March was higher than expected, up to 53 billion from the projected 44 billion and 16 billion higher than the deficit reported in March 2014.

When we talk about budget deficit, it means that the total National Debt increased proportionally that month. The higher the deficit, the faster the National Debt grows. And the National Debt is an accumulation of deficits.

It is important to note that while the National Debt increased from around 6 trillion to about 10 trillion during the period 2002-2008 due to the high cost of wars in Iraq and Afghanistan, it has increased 8 trillion more since 2009 in spite of US withdrawal from those wars.

This splurge of budget dollars emulate irresponsible policies at countries like Greece or Argentina, giving a false appearance of growth and well being promoted by elected politicians being "generous" toward their own generation, with wealth that has been immorally looted from the labor of future generations. It is very simple, just like any household budget, people cannot keep charging their credit cards forever if they do not count with real means or prospects to pay back their debt obligations.

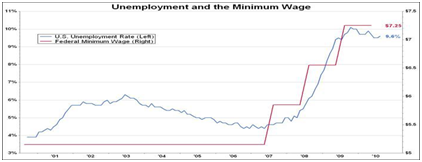

It is also important to note that the National Debt obviously cannot be serviced by income taxes from people that are no longer employed. And the doctoring of the unemployment figures is another sign of irresponsible government. It is astounding that so few people, even Economists, pay attention to the real figures. However, they are not secret or hidden; in fact they are available to all of us.

- Hits: 12659