Either US government officials do not know anything about economics

or they do not care to hire Economists to show them the facts

and their foreseable consequences.

It was reported today that the US budget deficit this March was higher than expected, up to 53 billion from the projected 44 billion and 16 billion higher than the deficit reported in March 2014.

When we talk about budget deficit, it means that the total National Debt increased proportionally that month. The higher the deficit, the faster the National Debt grows. And the National Debt is an accumulation of deficits.

It is important to note that while the National Debt increased from around 6 trillion to about 10 trillion during the period 2002-2008 due to the high cost of wars in Iraq and Afghanistan, it has increased 8 trillion more since 2009 in spite of US withdrawal from those wars.

This splurge of budget dollars emulate irresponsible policies at countries like Greece or Argentina, giving a false appearance of growth and well being promoted by elected politicians being "generous" toward their own generation, with wealth that has been immorally looted from the labor of future generations. It is very simple, just like any household budget, people cannot keep charging their credit cards forever if they do not count with real means or prospects to pay back their debt obligations.

It is also important to note that the National Debt obviously cannot be serviced by income taxes from people that are no longer employed. And the doctoring of the unemployment figures is another sign of irresponsible government. It is astounding that so few people, even Economists, pay attention to the real figures. However, they are not secret or hidden; in fact they are available to all of us.

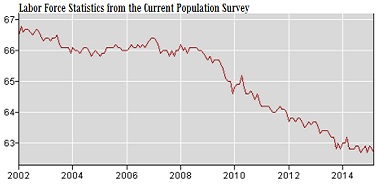

According to the numbers the US Bureau of Labor Statistics takes from the Census Bureau, as reported on the St. Louis Federal Reserve's website, as of february 2015, the percentage (62.8%) of employed, able-bodied, non-military persons, remains next to its lowest level (62.7%) IN OVER 37 YEARS. See the chart:

In addition, all readers may take a peek at the "US Debt Clock" ◄click here, and check on the many up-to-date figures useful to understand what is actually happening. Those figures are showing while these words are being written that the official unemployment figures are 8,528,533, but those actually unemployed number 17,036,612.

The hidden reason for this discrepancy is the "unemployment rate" deception promoted by the US government, that pretends jobs are up and unemployment is down - which is the opposite of reality. The "unemployment rate" is arrived at by ignoring, and excluding from the number, the "discouraged unemployed" who stopped looking for work and others who enter the informal work force receiving irregular hourly wages not reported to the IRS.

According to figures extracted from the Bureau of Labor Statistics, the Civilian Labor Force Participation Rate, stable at 66% to 67% from 1988 to 2009, collapsed to about 62/63% today. Everyone may check the monthly adjustments for these rates clicking on this link. What they include as Civilian Labor Force are: "All members of the population aged 16 or over in the United States who are not in the military or institutions such as prisons or mental hospitals and who are either employed or are unemployed and actively seeking and available for work".

This deception results from the fact that every month the U.S. Department of Labor releases the unemployment rate, which is the percentage of the civilian labor force that is unemployed and officially seeking employment. But in very bad economic times, this unemployment rate is quite deceptive because it does not consider discouraged workers and others in part time informal occupations.

Between inauguration day of the present US Administration in January 20, 2009 when total U.S. debt stood at $10,626,877,048,913, through election day Nov 6 2012, the National Debt had increased to $16,214,358,823,745. In other words, during this single presidential term, the TOTAL OF ALL DEBT ACCUMULATED THROUGHOUT THE ENTIRE HISTORY of the United States, INCREASED BY OVER 65%, adding over 5.5 trillion dollars to the US crushing debt burden!!!

And that is the overwhelming problem. Because the budget splurge has not just continued but it has accelerated. At 4:27 pm on Tuesday, April 14th, the National Debt stands at $18,187,145,266,641, according to the US Debt Clock. That means that the total accumulated National Debt has reached $155,000 per taxpayer. In other words, every US taxpayer would have to pay an average of $155,000 in taxes to eliminate the National Debt.

But the heart of this problem beats at the taxpayer voting tendencies. Is it any surprise that so many selfish voters are so willing to stick future generations with the bill, voting for politicians that promise evermore government largesse and spending when it won't cost those voters anything but the good life at the expense of credit that other will pay in the future? All government spending that does not come from treasury abundance, from a balanced budget, is nothing more than theft of the property - and futures - of US children and their children. And because of the weight of the US economy on the rest of the world, the debt crisis of the future will be a world-wide disaster.

In addition to the Civilian Labor Force Participation Rate being at it's lowest level in 37 years, the "hope and change" promised by President Obama in 2008 turned into a "hopeless change", with mushrooming debt as his crown. The false perception of an economy purchased by the Federal government with National Debt bonds is evident in what we borrowed and squandered out of proportion of the GNP growth, up to 8 trillion dollars since that hopeful inauguration. It is painfully obvious that the government is surreptitiously stealing from future generations to pay people to stay home from work today with extended unemployment benefits or to live on welfare. If the economy is in such good standing, why is it that Food Stamp recipients increased from some 29 million in 2008 to more than 46 million today? Why those registered as "living in poverty" increased from 38 million to more than 44 million today? And why the discrepancy where more people receive food stamps than those counted as living in poverty? Is that another example of populist largesse?

The populist solution of "taxing the rich" is a mirage. The rich are proportionally taxed more than the poor. Tax rates are proportionally higher as the family income is higher. And even if the US government confiscated all income and all property from the hated top 1%, the total worth of all those American billionaires would not even cover 8% of the National Debt. In addition, the US has the higher corporate taxes of the industrialized world. An unrealistic increase in taxation would only result in a damaging rush of capital fleeing to foreign shores and resulting in more unemployment.

The fact is that the top 1% pays nearly 40% of the total US tax revenues. While the top 10%, all those with annual adjusted gross incomes above $110,000, pay 71%. On the other hand, 44 million registered as "living in poverty" (15% of the US population) pay 0% income tax. Therefore, the populist solution of "taxing the rich" is a mirage. They are already being heavily taxed. While they are the most generous in charity donations and charity foundations in comparison with millionaires and billionaires from the rest of the World. Hundreds of US billionaires and millionaires have publicly pledged to dedicate the majority of their wealth to philanthropy. That is a seldom mentioned fact.

Some economist are against austerity measures. Such measures are certainly painful and they may be harmful if not balanced and backed with measures supporting capital investments and enticing industries to return from foreign ventures to a friendlier financial environment. But even if austerity is not properly planned, it is still a better solution in the long run than further budgetary squandering. And this applies not only to the US but to Greece, Argentine and most other countries.

Chinese political leaders have suggested that they will conquer the world through economics. They have had a balanced budget for many years. And they are already the third largest economy in the World. The US is still the first ... in numbers. But with current U.S. national debt held by the Chinese totaling more than 5 ½ trillion dollars it's quite safe to suggest they already have.

It is high time to apply firmly the brakes to the US budget and give further incentives to investors in new technologies and emerging enterprises. It is still not too late.

Comments powered by CComment