El poder económico y militar de China es real pero no basta para lograr sus propósitos supremacistas

Un reportaje testimonial aparecido en The New York Times remitido por una residente de Beijing señala la desesperación de amplios sectores del pueblo chino, encubierta por las autoridades, relatando que: «Hoy, a muchos de nosotros nos resulta más difícil sentir orgullo. Detrás del orden de la vida cotidiana, hierve una silenciosa desesperación. En las redes sociales y en conversaciones privadas, se repite un estribillo común: preocupación por el desempleo, los recortes salariales y llegar a fin de mes.»

Un reportaje testimonial aparecido en The New York Times remitido por una residente de Beijing señala la desesperación de amplios sectores del pueblo chino, encubierta por las autoridades, relatando que: «Hoy, a muchos de nosotros nos resulta más difícil sentir orgullo. Detrás del orden de la vida cotidiana, hierve una silenciosa desesperación. En las redes sociales y en conversaciones privadas, se repite un estribillo común: preocupación por el desempleo, los recortes salariales y llegar a fin de mes.»

En su testimonio, subraya también que: «Hoy en día, existe un sentimiento de amarga ira entre la gente por ser víctimas sin voz de la obsesión del Estado con el poder mundial y con superar a Estados Unidos. Es probable que ese sentimiento crezca. El último plan quinquenal —el plan maestro del gobierno sobre prioridades económicas— publicado el mes pasado deja claro que planea redoblar la apuesta por priorizar el poder militar sobre el bien común.»

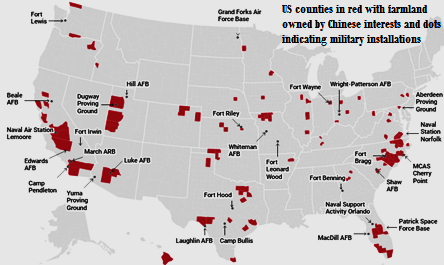

Esto es cierto y Estados Unidos lo ha estado ignorando durante largo tiempo, permitiendo que China haya estado cerrando rápidamente la brecha en la carrera armamentista, mostrando liderazgo en áreas críticas de tecnología como AI, tecnología hipersónica y guerra cibernética, al tiempo que expande rápidamente su arsenal nuclear, aunque aún se encuentra a la zaga de los EE.UU. Desarrolla así un extenso programa de competencia estratégica multifacética tanto en los ámbitos tradicionales como tecnológicos. Mientras los EE.UU. todavía han mantenido ventajas en poder militar agregado y algunos sistemas de alta gama (o high-end systems: tecnologías de vanguardia que combinan potencia de fuego con capacidades digitales avanzadas para obtener una superioridad estratégica decisiva), es cierto también que China sobresale en tecnología emergente, desafiando la supremacía norteamericana en el espacio y la red, lo que ha obligado a Estados Unidos a reevaluar urgentemente su perspectiva estratégica.

No obstante, el reportaje testimonial que estamos citando destaca que: «Esa fachada de fortaleza se resquebraja aquí en China, donde la desesperación ante la disminución de las perspectivas económicas y personales está muy extendida. Este contraste entre un Estado confiado y una población agotada se resume en una frase que los chinos utilizan para describir su país: "wai qiang, zhong gan", que se traduce aproximadamente como "fuerte por fuera, frágil por dentro".»

China se enfrenta a importantes obstáculos estructurales, como una persistente caída del mercado inmobiliario, un consumo interno débil, presiones deflacionarias y una frágil confianza del sector privado, lo que se traduce en un crecimiento inferior al esperado en áreas como las ventas minoristas y la inversión, a medida que se aleja de la expansión impulsada por el sector inmobiliario y por el enorme superávit comercial.

- Hits: 95

oro, la plata y el platino. La plata y el platino, sobre todo, experimentaron un alza sin precedentes del 170% durante el año y el alza de los precios del oro fue también importante, aumentando un 73%.

oro, la plata y el platino. La plata y el platino, sobre todo, experimentaron un alza sin precedentes del 170% durante el año y el alza de los precios del oro fue también importante, aumentando un 73%.

Después de 14 votaciones y 43 días del estancamiento más largo de la historia por cuestiones presupuestarias, se logró el 9 de noviembre una votación bipartidista que acomodó la supermayoría necesaria de senadores para llegar a un acuerdo para cesar la congelación de fondos y reabrir el gobierno. Siete demócratas y un independiente se unieron a 52 de los 53 republicanos para alcanzar los 60 votos necesarios para avanzar.

Después de 14 votaciones y 43 días del estancamiento más largo de la historia por cuestiones presupuestarias, se logró el 9 de noviembre una votación bipartidista que acomodó la supermayoría necesaria de senadores para llegar a un acuerdo para cesar la congelación de fondos y reabrir el gobierno. Siete demócratas y un independiente se unieron a 52 de los 53 republicanos para alcanzar los 60 votos necesarios para avanzar. constantemente en cuanto a los errores que se cometen al tratar de emplear los antiguos métodos y recursos para resolver nuevos problemas y conflictos. Por ejemplo, durante la II Guerra Mundial, Estados Unidos desarrolló en sólo 117 días el mejor avión de combate de ese conflicto, el P-51 Mustang, y lo produjo por sólo 50,000 dólares cada uno, es decir, aproximadamente 500,000 dólares de hoy, dejando atrás la tecnología de la época y, además, produciéndolo en masa gracias a su bajo costo.

constantemente en cuanto a los errores que se cometen al tratar de emplear los antiguos métodos y recursos para resolver nuevos problemas y conflictos. Por ejemplo, durante la II Guerra Mundial, Estados Unidos desarrolló en sólo 117 días el mejor avión de combate de ese conflicto, el P-51 Mustang, y lo produjo por sólo 50,000 dólares cada uno, es decir, aproximadamente 500,000 dólares de hoy, dejando atrás la tecnología de la época y, además, produciéndolo en masa gracias a su bajo costo. de millones de dólares.

de millones de dólares. los aliados construyeron aproximadamente 186,000 tanques. Por el contrario, los costos incontrolables e insostenibles de los armamentos de hoy son evidentes en todas partes. El precio de más de 15 mil millones de dólares por un portaaviones (sin contar los aviones y los buques auxiliares), 500 millones de dólares por un B-2 y 7 millones de dólares por un tanque no permite comprar o producir muchos de ellos. Y las grandes Potencias que hacen alarde de ellos no pueden permitirte perder ninguno. Aparte de los costos, se necesitan muchos meses o años para producir más de esos costosos aparatos y los rusos están pagando el precio en una guerra sumamente costosa y prolongada.

los aliados construyeron aproximadamente 186,000 tanques. Por el contrario, los costos incontrolables e insostenibles de los armamentos de hoy son evidentes en todas partes. El precio de más de 15 mil millones de dólares por un portaaviones (sin contar los aviones y los buques auxiliares), 500 millones de dólares por un B-2 y 7 millones de dólares por un tanque no permite comprar o producir muchos de ellos. Y las grandes Potencias que hacen alarde de ellos no pueden permitirte perder ninguno. Aparte de los costos, se necesitan muchos meses o años para producir más de esos costosos aparatos y los rusos están pagando el precio en una guerra sumamente costosa y prolongada.