President Trump has dragged his administration into an economic Cold War by imposing high tariffs and sanctions on most countries and blocs of countries that trade with the United States. He announced that all of them had been pursuing trade policies significantly detrimental to the United States' interests for many decades. In particular, exchanging goods and services with China resulted in a growing trade deficit amounting to hundreds of billions of dollars. To a lesser extent, this disparity was also notable in trade with the European Union, India, and many other countries. Therefore, President Trump took the plunge with a sudden and radical policy of achieving parity, which provoked a loud and belligerent reaction among those affected and an avalanche of criticism in the American media and political circles, which predicted an economic collapse caused by overwhelming initial inflation and the subsequent descent into a deep depression.

President Trump has dragged his administration into an economic Cold War by imposing high tariffs and sanctions on most countries and blocs of countries that trade with the United States. He announced that all of them had been pursuing trade policies significantly detrimental to the United States' interests for many decades. In particular, exchanging goods and services with China resulted in a growing trade deficit amounting to hundreds of billions of dollars. To a lesser extent, this disparity was also notable in trade with the European Union, India, and many other countries. Therefore, President Trump took the plunge with a sudden and radical policy of achieving parity, which provoked a loud and belligerent reaction among those affected and an avalanche of criticism in the American media and political circles, which predicted an economic collapse caused by overwhelming initial inflation and the subsequent descent into a deep depression.

However, as the weeks passed by and the economic sanctions and tariffs against trade rivals increased, we started to see a growing willingness to negotiate with the United States toward a fair trade policy. This trend started with the United Kingdom, and agreements were soon reached with China, which, up until recently, would not budge to this pressure but was forced to do so by the overwhelming economic shock it was suffering. Furthermore, it is known that around 80 other countries, including those in the European Union, were requesting to enter into negotiations.

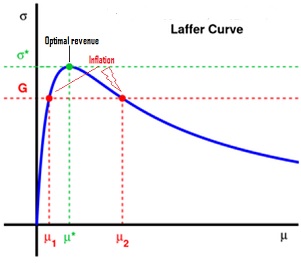

It is noteworthy that a renowned American economist and Nobel Prize nominee, Dr. Art Laffer, is not among the critics raising the specter of an economic collapse, but quite the opposite. Laffer is the author of the economic theory illustrated by what is now called "the Laffer Curve," which graphs the theoretical relationship between tax rates and the resulting levels of government tax revenue.

When this theory is applied to Trump's tariffs, it is not surprising to find that the predictions of so many critics are economically unfounded and that this policy is a good way to negotiate trade accords that are advantageous to all parties. Yes, "to all parties," since a balanced global commerce free from protectionist policies and a favorable cost/price balance for producers and consumers is made possible by free trade, which requires parity in the rules and regulations governing world trade.

Notably, this prominent economist analyzed last Tuesday on "Varney & Co." President Donald Trump's claim that the United States was being "ripped off" by other countries. He declared that both the world and the United States would benefit from President Donald Trump's tariffs and the resulting trade negotiations. Furthermore, Laffer stated that "the win-win Trump’s strategy is just phenomenal at negotiating," and asserted that Trump's tariffs will lead to global prosperity, adding that he agreed with President Donald Trump that foreign countries getting hit with the president’s latest levies "have far higher tariffs and non-tariff barriers and quotas than we do." Furthermore, Art Laffer and Stephen Moore had written an op-ed titled "A Win-Win Exit Strategy for Trump on Tariffs," published Monday in the Wall Street Journal, which elaborates on this topic.

In practical terms, we must consider the U.S. Department of the Treasury reports that in 2024, US$ 2.43 trillion was collected in federal individual income taxes (FiscalData, 2025), representing just under half the $4.92 trillion total tax take. Economists have known that —if raising revenue is the sole objective— the tax rate that maximizes revenue is finite. A zero tax collects, by definition, no revenue for the government, but if the tax is too high, the taxed subjects give up entirely on the economic activity being taxed, and tax revenue would tend to drop to zero as well. So, Laffer contended, there must be a turning point somewhere between the extremes where tax revenues max out. And according to Laffer, the same theory applies to trade tariffs. Therefore, if implemented fairly, an ideal mutual 10% worldwide import tariff would raise nearly $500 billion in annual income to the U.S., would not interfere with normal trade, and would significantly lower the US trade imbalance.

Meanwhile, senior members of the new U.S. administration, including President Donald J. Trump himself, have claimed that import tariffs can be raised to levels that can finance significant tax cuts. Just recently, the President’s senior trade advisor, Peter Navarro, claimed that $600 billion more could be collected each year in import taxes, quite in tandem with Laffer analysis. That means that policymakers would have the opportunity to use the increased government revenue to reduce income taxes up to 15-20% on American families, or they’ll have a choice to further invest billions in growing the economy through tax credits that promote investment in American manufacturing.

Let's give these policies time to see the initial results of this strategy. Only then would it be fair to criticize or praise it with full knowledge of the facts.

Comments powered by CComment