La historia del Socialismo como ideología y como movimiento político se consolida en el pensamiento que promovió la Revolución Francesa y que actúa a través de ella hasta desembocar en el totalitarismo comunista (leninista) a principios del siglo XX y consolidarse en los sistemas totalitarios que nos han aquejado a lo largo de ese siglo hasta nuestros días.

La historia del Socialismo como ideología y como movimiento político se consolida en el pensamiento que promovió la Revolución Francesa y que actúa a través de ella hasta desembocar en el totalitarismo comunista (leninista) a principios del siglo XX y consolidarse en los sistemas totalitarios que nos han aquejado a lo largo de ese siglo hasta nuestros días.

Los que defienden la Revolución Francesa como paradigma de la democracia se empeñan en negarlo, disfrazarlo u ocultarlo, pero la realidad histórica demuestra que junto con la revolución industrial que conmocionó al siglo XIX podemos encontrar que ya desde los primeros años de ese siglo Saint-Simon puso el acento agudo en la necesidad de la planificación de la economía. Calificado como "padre de la Sociología", fue promotor de lo que llamó "fisiología social" y de su "Filosofía Universal de la Historia", mediante la cual le daba un nuevo enfoque a los hechos históricos y proponía una reorganización social patrocinada por el Estado, lo cual determinó que se lo situase posteriormente dentro del campo del socialismo utópico.

Por su parte Jean-Baptiste Fourier denunció el "capitalismo alienatorio" y aportó una particular concepción dialéctica de la historia (influenciado por Hegel y adelantándose a Marx y Engels). Además, en el Diccionario soviético de filosofía[1] se presenta la filosofía de Carlos Fourier como la de un gran socialista utópico, el cual se manifestó con una brillante crítica de la sociedad burguesa en su obra "Teoría de los cuatro movimientos y de los destinos universales".

Así podemos recorrer toda una lista de otras personalidades de la época que sembraron la semilla del Socialismo. Más adelante, por ejemplo, Bazard y Leroux desarrollaron el socialismo de Saint-Simon, adentrándolo en la lucha de clases, y Pecqueur defendió la implantación de un programa colectivista que influyó notablemente en el pensamiento del barón belga de Colins. Otros teóricos del naciente socialismo moderno fueron Lamennais, que preconizaba la emancipación de la clase obrera por la distribución social de la propiedad; Cabet, que desarrolló el "comunismo" oweniano[2]; Blanc, que destacó el papel del Estado en la reforma y control de una sociedad "más justa"; Blanqui, empeñado en la conquista del poder y la implantación de una dictadura revolucionaria, etc., etc.

- Hits: 2066

La semana estuvo, sin duda, marcada el resultado de la primera vuelta electoral en Brasil. Otra vez los más reputados encuestadores dejaron jirones de su prestigio por los tan equivocados resultados que pronosticaron, producto tanto de vender sus análisis al mejor postor cuanto de la tentativa de influir en la opinión de los ciudadanos. En ese mismo error incurrió el Frente de Todos, que confundió deseos con realidad y tanto apostó a un definitivo triunfo de Luiz Inácio Lula da Silva (48,43%). Los muchísimos votos obtenidos por el tan repudiado Jair Bolsonaro (43,20%) aguaron la fiesta aquí prevista por el Gobierno para celebrar la resurrección de la Patria Grande que el Foro de San Pablo imagina para la región y para exhibir un éxito en su teoría del lawfare. El segundo turno electoral se disputará el 30 de este mes, y su resultado todavía es imposible de prever.

La semana estuvo, sin duda, marcada el resultado de la primera vuelta electoral en Brasil. Otra vez los más reputados encuestadores dejaron jirones de su prestigio por los tan equivocados resultados que pronosticaron, producto tanto de vender sus análisis al mejor postor cuanto de la tentativa de influir en la opinión de los ciudadanos. En ese mismo error incurrió el Frente de Todos, que confundió deseos con realidad y tanto apostó a un definitivo triunfo de Luiz Inácio Lula da Silva (48,43%). Los muchísimos votos obtenidos por el tan repudiado Jair Bolsonaro (43,20%) aguaron la fiesta aquí prevista por el Gobierno para celebrar la resurrección de la Patria Grande que el Foro de San Pablo imagina para la región y para exhibir un éxito en su teoría del lawfare. El segundo turno electoral se disputará el 30 de este mes, y su resultado todavía es imposible de prever.

Querido Santo Padre:

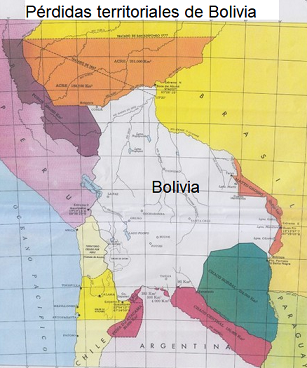

Querido Santo Padre: poco definidos y claros. Con tres regiones diferentes: La costa, la zona andina y el Oriente. Sólo la zona andina estaba organizada en la cual existía varias ciudades, entre ellas Charcas (Sucre), La Paz, Cochabamba, Potosí y otras. El Oriente estaba casi deshabitado, la excepción era la ciudad de Santa Cruz de la Sierra, esta región había luchado con mucho heroísmo por la independencia, donde se destaca la Batalla del Pari. En la costa había casi nada al extremo que no pudimos organizar una Marina Mercante y peor una Marina de Guerra.

poco definidos y claros. Con tres regiones diferentes: La costa, la zona andina y el Oriente. Sólo la zona andina estaba organizada en la cual existía varias ciudades, entre ellas Charcas (Sucre), La Paz, Cochabamba, Potosí y otras. El Oriente estaba casi deshabitado, la excepción era la ciudad de Santa Cruz de la Sierra, esta región había luchado con mucho heroísmo por la independencia, donde se destaca la Batalla del Pari. En la costa había casi nada al extremo que no pudimos organizar una Marina Mercante y peor una Marina de Guerra.