| The New York Times y otros medios de prensa escrita, radial y televisiva lo ponen en duda, destacando su fracaso como mediador en Ucrania y en Gaza. CNN califica las alegaciones del Presidente en una nota publicada en agosto como «la clásica hipérbole trumpiana.» Y pregunta: «¿Está Trump comprometido con el largo plazo o solo con acuerdos que puede promocionar?» |

Sept.30 (DPnet).– Aunque ha fracasado hasta ahora en lograr la paz que había anunciado inminente en Ucrania y Gaza bajo sus auspicios durante la campaña que lo llevó a la Casa Blanca, el Presidente Trump ha alardeado que sus esfuerzos mediatorios han sido instrumentales para alcanzar la paz en otras siete guerras durante los 8 primeros meses de su gobierno. La verdad encierra varios matices sobre la importancia y los resultados de su alegada mediación. Veamos:

Camboya vs Tailandia – Trump amenazó con poner fin a las negociaciones comerciales e imponer aranceles del 36%. Aprovechó también las estrechas relaciones militares con Tailandia y se logró un alto al fuego entre ambos países. Mediaron también Malasia y China.

Serbia vs Kosovo – No ha sido en los primeros siete meses de su segundo mandato sino en 2020 cuando Trump consiguió que las partes se reunieran en Estados Unidos y firmasen un acuerdo de normalización económica y aceptaran una fuerza de paz de la OTAN, que en la actualidad suma 4000 soldados.

- Hits: 352

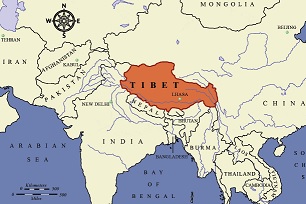

When China occupied Tibet in 1950 to "liberate" Tibet from its "economic backwardness" of feudal and religious traditions, the effects were devastating. Tibetans were dispatched to labour camps, monks and nuns were executed or imprisoned, thousands of monasteries and temples were destroyed, and communist propaganda was forced upon the Tibetan people. An estimated 130.000 Tibetans are living in India today. The vast majority travels to India through Nepal (where some 14,000 Tibetans are exiled), but a few go through Myanmar (Burma) or straight through India's northeastern parts. Travel is undertaken mostly by foot, and in groups of 5-15 persons because of safety issues.

When China occupied Tibet in 1950 to "liberate" Tibet from its "economic backwardness" of feudal and religious traditions, the effects were devastating. Tibetans were dispatched to labour camps, monks and nuns were executed or imprisoned, thousands of monasteries and temples were destroyed, and communist propaganda was forced upon the Tibetan people. An estimated 130.000 Tibetans are living in India today. The vast majority travels to India through Nepal (where some 14,000 Tibetans are exiled), but a few go through Myanmar (Burma) or straight through India's northeastern parts. Travel is undertaken mostly by foot, and in groups of 5-15 persons because of safety issues. People’s Republic of China (PRC) that encompasses roughly half of Tibet. While Chinese state media is striking a predictably upbeat tone on the anniversary, the reality is that Tibetans have little to celebrate.

People’s Republic of China (PRC) that encompasses roughly half of Tibet. While Chinese state media is striking a predictably upbeat tone on the anniversary, the reality is that Tibetans have little to celebrate.