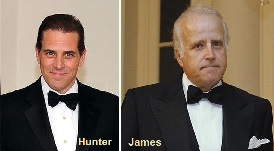

Los indultos preventivos de Biden son indultos emitidos antes de que se hayan presentado cargos y se hayan dictado condenas o sentencias. Esencialmente, es una forma de proteger a alguien de posibles problemas legales incluso antes de que se revelen y puedan ser juzgados.

Son muchos los que tratan de enfatizar que esta prerrogativa presidencial es legal de acuerdo con el Artículo II, Sección 2, de la Constitución de los Estados Unidos, aunque toda la lógica rechaza la legitimidad de una orden ejecutiva que pretende indultar a alguien de algo por lo que no ha sido juzgado o condenado, abriendo así la puerta a futuros actos de corrupción administrativa, sabiendo los involucrados que serán eventualmente indultados antes de que se les descubra el delito y puedan ser juzgados y condenados.

Veamos lo que dice la Constitución:

«El Presidente será Comandante en Jefe del Ejército y la Armada de los Estados Unidos, y de la Milicia de los diversos Estados, cuando sea llamada al servicio efectivo de los Estados Unidos; podrá requerir la opinión, por escrito, del funcionario principal de cada uno de los departamentos ejecutivos, sobre cualquier asunto relacionado con los deberes de sus respectivos cargos, y tendrá poder para conceder indultos por delitos contra los Estados Unidos, excepto en casos de juicio político.»

Lo que sigue del Artículo II es su capacidad de concertar tratados, nombrar embajadores y otros nombramientos y llenar vacantes.

Por tanto, los que justifican el "perdón preventivo" se basan en la última frase, argumentando que «los indultos preventivos son legales en los Estados Unidos y caen bajo los amplios poderes otorgados al presidente por el Artículo II» y ponen de ejemplo el caso resuelto en 1866 por la Corte Suprema: Ex parte Garland. Pero este caso se refiere a eximir de un posible castigo a la persona que haya cometido un delito que no ha sido juzgado cuando el castigo a ese delito fuera aplicado mediante una ley o reglamento de forma retroactiva, es decir, por una ley sancionada posteriormente al delito.

Por tanto, y descartando este ejemplo justificatorio, independientemente del tipo de clemencia en cuestión, el poder del Presidente se extiende sólo a los «delitos contra los Estados Unidos», es decir, a los delitos federales, pero no a los estatales o civiles.

- Hits: 1098

It’s necessary to note that several assumptions underlying that motivation are debatable. The answer to what Politico’s writers characterized as “finicky water supplies” is to build more water supply infrastructure and reform delta management. It’s also incumbent on proponents of massive photovoltaic installs to evaluate the heat island impact of 200 square miles of absorbent black panels. We must also mention the biggest elephant in the room, the fact that even with battery storage so photovoltaic panels can supply continuous electricity day and night, there are massive seasonal fluctuations. In 2023, California’s utility-scale photovoltaics generated 4,456 gigawatt-hours in June, but only 1,832 in December. If California goes even bigger on photovoltaics, good luck selling your power in June.

It’s necessary to note that several assumptions underlying that motivation are debatable. The answer to what Politico’s writers characterized as “finicky water supplies” is to build more water supply infrastructure and reform delta management. It’s also incumbent on proponents of massive photovoltaic installs to evaluate the heat island impact of 200 square miles of absorbent black panels. We must also mention the biggest elephant in the room, the fact that even with battery storage so photovoltaic panels can supply continuous electricity day and night, there are massive seasonal fluctuations. In 2023, California’s utility-scale photovoltaics generated 4,456 gigawatt-hours in June, but only 1,832 in December. If California goes even bigger on photovoltaics, good luck selling your power in June.

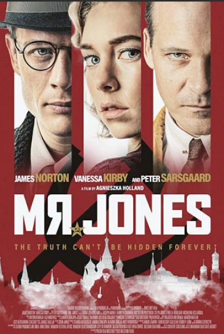

Hambruna (1932-33) causada por el desatino soviético-estalinista.

Hambruna (1932-33) causada por el desatino soviético-estalinista.