Basically, Money is a medium for the exchange of property and a tangible instrument for the payment of services. Therefore, Money means "property"; it is a measurement of "value"; and is used as a tool for two parties to benefit by fair exchange in a transaction. The sole purpose of Money is to facilitate the exchange of property and services in a fair manner. But Money is in practice a much more complicated thing: in all its forms, bullion, standard coin, token coin, convertible and inconvertible notes, legal tender and not legal tender, checks, stock, etc., it functions as an instrument of exchange. In brief, economists use to define the "functions" of Money as a medium of exchange, a measure and a store of value and a standard of deferred payment.

For many centuries since antiquity Money has been pegged in one form or another to the value of Gold and Gold was used as a standard measure of exchange. In fact, contrary to some modern perceptions and uses, Gold is neither a commodity nor an investment.

It is not a commodity because Gold has very few practical uses. Commodities are undifferentiated goods produced to satisfy various needs or wants, such as oil, wheat, corn, aluminum, copper, etc., and they are consumed as food or energy or they serve as inputs to other goods demanded for “consumption”. Gold is not “consumed”; it is not an industrial necessity. Practically all gold that has been mined throughout history is being hoarded as a “reserve” in government vaults or is being used as an ornament with no practical value. There is no other real demand for gold. However it is the only metal that does not decay. It is the most stable metal in nature. And it shines beautifully. Therefore, it is a useful and reliable item as a measurement of “value” and it has supported the value of paper money (legal tender) as part of government reserves up to the last century. In modern days it was fixed as the “gold standard” and meant that you may claim a fixed amount of gold in exchange for the legal tender in your hands.

On the other hand, it is not an investment because it is not an instrument that may expand or contract in value in tandem with normal laws of supply and demand and it does not offer a rate of return.

True Money, such as gold, has no return because it has no intrinsic risk. It’s perceived “value” depends on government decisions and on the psychology of those affected by those decisions. That is why it is sometimes subject to speculation moved by consumers’ fear. Nowadays it no longer depends much on government decisions but on the psychology of consumers that still consider Gold as a last refuge against inflation, financial collapse and/or poor government.

In fact, legal tender has been debased progressively in the course of the last 70-80 years. The “gold standard” gave way in the United States to the “silver certificate”. But silver is a commodity and therefore when its price was artificially pegged to a currency it created real distortions from its real market price. It could not last.

The United States opted then for a “Federal Reserve Note” and other countries having strong currencies followed a similar path of debasement.

Up to that moment Money as a measure of exchange functioned because you were giving a promissory note of gold or silver in exchange for goods and/or services. However, after the 1970’s Money turned from a measure of “value” to a measure of “credit”. In fact, paper

money or any other currency transaction is now a credit arrangement where you get goods and/or services in exchange for a government promise to maintain the purchasing power of that currency, so that you may get other goods and/or services of similar value with that “certificate”. But that “certificate” by itself has no value at all. It is no real Money.

This system was created under the Keynesian theories of economic growth or financial expansion based on credit. This writing is no place to enter into theoretical consideration, so let us concentrate on the facts. This system was a smart experiment to stimulate the economy up to the point that governments would use it within reasonable limits. But governments acted just as many consumers do. They kept accumulating credit on a false pretense of promoting well being and “economic growth” up to the point where they no longer were able to pay. In other words, the same plight facing consumers that use credit cards to acquire goods and/or services at a level well above their income and financial possibilities.

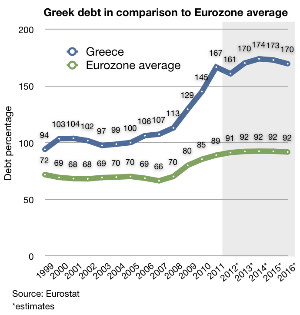

Sooner or later that path takes consumers as well as whole countries to bankruptcy. Smaller countries with weak economic frameworks and weak currencies have repeatedly collapsed under such policies. Argentina, Iceland, Ireland, Italy, Spain and now Greece collapsed. They lived for some time under the false pretense of economic growth and relative opulence, but it was a mirage based on credit and not on the real value of their industry and productivity. Strong industrialized countries with currencies used as a monetary “reserve” such as the US and the dollar and the United Kingdom and the pound avoided collapse creating more currency with the only backing of their credit reputation. They simply increase their “money supply”. In other words, they print more paper. Japan and the yen tried to reach the same level of immunity but the yen was not strong enough to sustain budgetary excesses and the Japanese have been suffering a long period of recession and minimal growth since their bubble exploded.

No wonder, this creation of currency with no real backing on productivity gives way to the erosion of purchasing power. Every additional dollar, every additional pound, every additional yen, buys less goods and services every year. This fact is still worse for the peso, the bolivar, and other weak monetary instruments. It is a hidden form of taxation that creeps on our daily life eroding our ability to maintain a standard of living with the same income. Facing this erosion, people use credit cards to keep up their level of living and governments issue bonds that they promise to pay with a certain added interest within a certain number of years with a similar purpose. In fact, by the time they pay these bonds, the money used to pay it back is greatly devalued. Therefore, even with the interest rate promised, bond investors get less purchasing power when cashing back their bond investments. That is why all these monetary schemes are no more than a hidden form of taxation. Governments spend borrowed money that they eventually pay with devalued currency.

If these monetary policies were used with discretion and moderation to stimulate the economy, foster new enterprises, inventions and research, and to maintain an efficient industrial infrastructure, things would work in the ladder of success and growth. But easy credit with fake Money created to pay for wasteful national budgets is a prescription for disaster. It steals prosperity out of the future to spend it today. Consider it this way: when individuals or companies write a check, there must be sufficient funds in the bank account to cover it, but when the US Federal Reserve writes a check, there is no bank deposit on which that check is drawn. When the Fed writes a check, it is creating “money” out of nothing. This fake currency is no Money at all but a simple receipt or an IOU. This is a system that departs from what the US founder fathers intended. George Washington said: “No generation has a right to contract debts greater than can be paid off during the course of its own existence”.

Let us remember that in the United States the Fed was created in 1913, the same year the Income Tax system was created. Both institutions have been accused of being unconstitutional because they function with their own laws outside constitutional boundaries. Let us consider the little known fact that the Fed has stock holders. The stock holders own the Fed. They receive a 6% annual dividend, but the general public has no access to a list of Fed stockholders (as they have with corporations). It is a very well kept secret. And they work in secret to manipulate currency policies. Even John Maynard Keynes criticized this arrangement in “The Economic consequences of the Peace” arguing that “there is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The point to understand this debauchery is that bank deposits are actual loans to the bank. We, the people, the institutions, the corporations, make bank deposits and the bank uses that money for loans, investments and many sorts of speculation at a given ratio (or cash reserve ratio) according to the law. A depository institution's reserve requirements vary by the dollar amount of net transaction accounts held at that institution. Effective January 23, 2014, the Fed decided that institutions with net transactions accounts:

- Of less than $13.3 million have no minimum reserve requirement;

- Between $13.3 million and $103.6 million must have a liquidity ratio of 3% of liabilities;

- Exceeding $103.6 million must have a liquidity ratio of 10% of liabilities

They did not have to pass a law in Congress to apply these rules.

These rules create a currency “multiplier”, because the same dollar is used repeatedly in many transactions. The bank takes the money deposited within the allowed ratio and the borrower uses it to pay for whatever was intended, or the bank itself uses it for investments and/or speculative transactions. But the borrower, the seller or the stock broker proceeds to deposit the money received back in the same bank or another bank. It does not matter because it is the same banking system. This centrifuge sends the money back to the banks in new deposits to be used again and again in a never ending chain. That is the “multiplier”. The original dollar deposited appears in several accounts at the same time. Therefore, currency in banks is no more than accounting numbers that reproduce and reproduce in what is called “the money supply”.

As the money supply increases, demand and prices increase and inflation is created. And governments feed on inflation as a hidden form of taxation. Detlev Schlichter, the author of Paper Money Collapse: the Folly of Elastic Money and the Coming Monetary Breakdown argues that “It is simply a historic fact that commodity money has always provided a reasonably stable medium of exchange, while the entire history of state paper money has been an unmitigated disaster when judged on the basis of price level stability. Replacing inelastic commodity money with state-issued paper money has, after some time, always resulted in rising inflation.”

Or worse! Is it by any chance farfetched to assert that this credit system is a legal, but illegitimate, form to create a speculative pyramid? In the world of private enterprise this is called a “Ponzi scheme”. A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. Ponzi scheme organizers often promise to invest your money and generate high returns with little or no risk. But sooner or later they have to use the newly invested money to pay those who invested earlier. If they fail to do so, the newly invested money dries. But they do not have a reserve value or tangible asset to back up their promises. With little or no legitimate earnings, Ponzi schemes require a constant flow of new money to survive. When it becomes hard to recruit new investors, or when large numbers of existing investors cash out, these schemes suddenly collapse.

What would be the legitimate way to conduct a proper monetary policy instead of this huge legalistic Ponzi scheme? On the one hand, a return to the gold standard to back-up currencies with something of real value. In order to avoid an excessive restriction of credit, gold reserves may be set at a low percentage of total currency in circulation. In addition, the price of gold may be allowed to float within certain boundaries, based on the market's choice of a monetary medium partially regulated by market forces, by the free, voluntary and spontaneous interaction of the trading public and not by government dictate, where governments would only act to restrict speculation. On the other hand, it would be wise to break big banks into units that are not “too big to fail” and to restrict their stock market and commodity operations. Banks should not act as brokers using deposits that were not intended for risky speculation. In addition, it is important to decentralize stock exchanges by returning to a system of regional ones to provide redundancy.

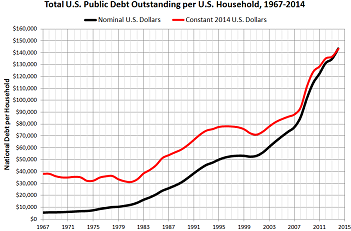

However, that would not be enough if governments of industrialized countries such as the United States use their huge resources to manipulate the public debt. They keep increasing the money supply to cover the deficit and pay for the service of the debt. They will eventually reach a limit when people lose their trust in their ability to pay back or consumers realize the deep erosion of their purchasing power and decide in panic to cash out of the system. That is when currencies collapse, inflation explodes, and an economic depression sets in. Nobody is able to predict when Ponzi schemes collapse. No one knows how far the 19 trillion US debt will grow before reaching the ultimate unsustainable amount.*

You better believe that any similarities with a Ponzi scheme are not pure coincidence.

Either we reform the monetary system and drastically reduce wasteful national budgets or the world will face within a decade a period of misery, unemployment, hunger and revolt, because the next Great Depression will be world-wide and will mount to a disaster capable of undermining our whole civilization.

* Eurostat indicated that first-quarter debt levels in the eurozone for the first time surpassed the 9 trillion euro ($12.2 trillion) threshold in 2014. As of the 1st October 2015, it is 12,421 trillion ($18,64 trillion). The chart (right) shows public debt as a % of GNP.

Comments powered by CComment