Professor Alberto Montaner (an exile from Cuba) claims that the real revolution is not what really occurred in Venezuela, but rather what has occurred in Israel. The success of Israeli economy is attributed to its abandoning socialism(collectivism) and embracing the principles of market economy. This transformation from collectivism to individualism and market economy should be viewed as a real revolution performed without military coup and barricades, and without imposition of a caudillo in power.

Israel is a model that needs to be exported to the world, especially the underdeveloped ones. Western countries should embrace and support the Jewish state. The kibbutz was an attempt to blend Marxist and Zionist ideas in Israel. It called for the establishment of self-governing communities. The absence of private property, the replacement of the wage system with equal allowances for everybody, the integration of physical and white collar work, and the creation a society devoid of inequalities and class hierarchies, which for many years has symbolized egalitarian and anti-capitalist ideas.

The defeat of the Labor party during 1977 elections and the emergence of a right-wing party have drastically altered the fate of the kibbutz’s movement. It hastened the decline which decreased the importance of the communal settlements in the Israeli society. The 1985 economic crisis in Israel, seventy-five years after the creation of the first kibbutz, created a feeling of despair among the communal settlements. The need arose for making drastic changes in Kibbutz’s structure, adopting it to the needs of market economy.

The kibbutz embraced market principles, selling part of its land to city dwellers to build private homes, on land that was previously used for agriculture. Many people left looking for better-paid jobs in their cities, the communal dining hall was shut down, and the principle of equal allowances was terminated, and members started to get paid according to the type of work they performed.

A new neighborhood was built in the kibbutz for nonmembers. The residents would own these homes. This process brought back many members who had previously left. In 2010 the kibbutz population was 127,000, up from 115,300 in 2005. The factories located in the kibbutzim produce 9% of Israel’s industrial output, worth $8 billion and 40% of the agricultural output worth about $1.7 billion.

A good illustration of changes that occurred in the Israeli communal settlements is kibbutz Afikim, one of the oldest, established in 1932. It transformed itself from a collective settlement to a place dominated by private enterprises. Stores belonging to individual members opened, such as a barber shop, a bicycle repair store, restaurants, etc. Kibbutz Afikim was successful in transforming itself from a socialist venture to a capitalist profit-making institution.

In 1996 kibbutz Afikim established a committee that encouraged their members to open their own businesses. During the period 1996-2004, every three months a new business opened in the kibbutz. For example, with an investment of 20,000 shekels (around $5,500) a new fish store opened. In 2004 kibbutz Afikim started the official process of dislocation.

In 2011 there were approximately a hundred enterprises. In the majority of cases, bookkeeping was done by kibbutz’s administrators. The private businesses in the kibbutz are paying rent, electric water fees and taxes and, as kibbutz members, a special communal tax. Those who open businesses need to return the loan given to them by the kibbutz. Those whose businesses are successful keep the profits. On the other hand, those enterprises that lose money would face bankruptcy.

According to information from the kibbutz movement, there were 270 kibbutzim in Israel with 2,500 private enterprises. An important success story in kibbutz Afikim has been transforming the dairy by introducing into a computerized system that revolutionized milk production. The dairy is one of the oldest ventures; it started when the kibbutz was first established. The members of the kibbutz decided that improving the income derived from the dairy should be an important priority that could benefit all 1,500 members.

The kibbutz established a new company, Afimilk that computerized the cow’s milking process and was able to measure not only the amount of milk, but also how much fat or lactose it includes. It could measure the health status of the cow, enabling to maximize the amount of milk to be produced. This innovation made Israel the number one country in the world in milk production per cow. In developed countries, the average milk per cow per year is between 3,000 to 4,000 liters, while in Israel it is 12,000 liter yearly.

In the 1990s, with the arrival of close to 1 million immigrants from the former Soviet Union, a new initiative was introduced by the Government. The immigrants had high technical skills but lacked entrepreneurial experience. The new initiative helped inventors of new products to develop the skills needed to become exporters. This program was very successful. By 2009, the number of start-up companies had risen to 4,000.

The Israeli government encouraged international investors from Microsoft and Cisco to build their first R&D faculties outside the United States in Israel. Motorola’s R&D center in Israel is its largest worldwide. Citibank conducted international research to find a country where it could create a center for research and development in the financial field. It selected Israel. The center opened in December 2011.

In March 2011 Barclays announced the opening of a similar center in Israel. The finance minister claimed that building of these centers in Israel is a confirmation for the powerful Israeli human potential. Israeli scientists, engineers, and entrepreneurs are helping the United States to promote nation building and security. The Israeli Defense Forces (IDF) plays a crucial role in the country’s social and economic life. Being surrounded by unfriendly countries, threatening the Jewish State’s existence makes national security an important priority for the country.

On October 23, 2011, the government authorized payment of soldiers’ first year of higher education. Various ministers labeled this move as a revolution in education that will significantly reduce inequalities by making higher learning more accessible. The threats to Israel’s existence contribute to the rise of an entrepreneurship in the area of security.

The above illustration demonstrates how military service in Israel contributed to innovation. Many credit cards companies (Visa, MasterCard, and others) are obsessed with combatting fraud. They employ thousands of employees, including at least fifty with PhDs in engineering, whose role it is to solve this problem. An Israeli who used the computer to hunt down terrorists during his army service used his experience to start up a small company that combats credit card fraud after he completed his army service. This small company was sold to PayPal for $169 million. His military experience enabled him to learn many things that escaped others with more education and experience.

The secret spying technological Unit 8200 of the Israel Defense Forces opened its door for entrepreneurs. Those who served the unit would like to open that door to the public at large. Ultraorthodox Jews and Arabs are also encouraged to apply. The idea is to employ the experience of the soldiers in this unit to benefit the public at large. It is a program for any person who intends to initiate an entrepreneurial idea. It is intended especially for those people who have an idea, but lack the resources to advance their cause.

Kibbutz Sasa, a mile from the Lebanese border, was founded in 1949. It is the home of the main Plasan factory, which manufactures ballistic vests for soldiers and police and armor for Israeli Defense Forces. At the closing of 2011, 90% of $500 million in orders are from Europe and the United States. Orders increased a great deal as a result of the wars in both Iraq and Afghanistan. In 2009 Plasan opened a factory in Bennington, Vermont. While the 350 workers are Americans the technology is decidedly Israeli.

Vardi founded his first company in 1969 and assisted in establishing seventy Israeli tech enterprises. His ability to make international connections between people and companies from around the world became an important asset and a major reason for the growth of technological innovations in Israel. Vardi is living proof of what is needed in the new international economic system—the way to proceed in order to have a successful enterprise. He is able to amplify and expand the efforts of many people.

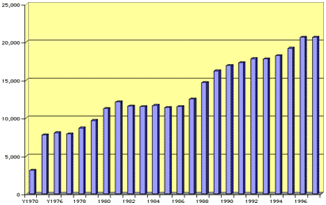

Technology-driven innovations necessitate the cooperation of many people from within or outside many countries. The Israeli export increased by 13,400 during the period 1948-2011. It increased from $6 million in 1948 to $80.5 billion in 2011. In the first years of Israel’s existence exports were mainly oranges, diamonds, and small industrial products. During the period 2001-2011, Israel’s main export was technology: electronics, computer programming, communication, and health. In 2010 hi-tech industries, including research and development, equaled $28.5 billion, which constituted 35% of Israeli exports.

Agricultural products amounted $1.3 billion, only to 2% of its exports. In 2010 Israel recorded defense exports, amounting to $7.2 billion, making the country one of the world’s top exporters of arms. Specializing in the production of unmanned aerial vehicles, mini satellites, and command-and-control systems, Israeli defense companies sold $9.6 billion in 2010, out of which $2.4 billion went to the Israeli Defense Forces. The Iron Dome, the country’s rocket defense system attracted much attention because of its success in intercepting kassam and katyusha rockets fired from Gaza Strip in Israel in April 2011.

Israeli economist Tamar Almor was asked how Israel was able to prevent an economic crisis. lmor pointed to Stanley Fischer, the Israeli central bank governor, and his decision to ensure that the government did not bail out any companies experiencing economic problems. During the year 2008, foreign direct investment in Israel increased by 11%, unemployment declined by 1.2%, and the GDP increased by 4.1%.

Prime Minister Benjamin Netanyahu declared in November 2011 that the Israeli economy continued to grow due to the fact that the budget framework was honored. He cited as an example what happened to the European countries, which faced an economic crisis resulting from an unrestrained increase in spending. By acting with responsibility, Israel was able to prevent the economic crisis facing the majority of the world. A special report issued by the Israeli central bank entitled, “Israel and the World Economic crisis 2007-2009,” recommended strengthening supervision of banks and increasing the responsibility of the institution headed by Stanley Fischer.

The need exists to follow a macro productive policy in order to assure that the financial system would not go into recession. As in Chile, the finance ministry and the Israeli central bank appointed a committee to further examine competition among the banks. Big businesses have no problems receiving loans with satisfactory interest rates, but small businesses face predicament on these issues. They will benefit from the reorganization of the bank system. During the period 2008-2011, Israel’s central bank purchased $50 billion in order to strengthen the declining price of the dollar in relation to the shekel.

As a result of this action the dollar increased in value in comparison to the shekel. Therefore, during the period July-September 2011, the bank ceased its intervention. The weakness of the euro has also negative implications for the local Israeli currency. Israeli program, which demonstrated its capabilities for coping with stress and trauma. An Israeli company Green 2000 is teaching African countries agricultural techniques and building greenhouses to increase food production. The African countries are very fertile but have very little agricultural knowledge. The Israeli company created an agronomic center in Nigeria employing the new tools and methods taught by the Israeli company, resulting in a threefold increase of agricultural production.

The first Israeli Prime Minister, David Ben-Gurion, had a dream of developing the desert in the south (Negev) and attracting many settlers to this area. Arava Power Company, a solar power company in southern Israel, is a fulfillment of Ben-Gurion’s dream. The company, which was built by an Israeli entrepreneurship, entered in partnership with a German conglomerate Siemens, which invested $15 million, enabling the company to become a major supplier of alternative energy. The company expects to grow into a $2 billion enterprise. It eventually will supply one-third of the energy needed for the nearby city of Eilat.

Former Israeli Finance Minister Yuval Steinitz asserted that it is important that China and India to have another route for transporting their exports to Europe in addition to the Suez Canal. A railroad would also increase the development of Israel’s southern Negev desert and possibly strengthen relations with Jordan; its Aqaba port is adjacent to Eilat and could also be connected to the railroad. The estimated cost of the project, which would be built by a Chinese government company in a joint venture between the two countries, is over $2 billion. In the future, the new railroad could also be used to export gas to India and possibly China, in the event that there new discoveries.

Dr. Roiter summarized the main ingredients of the Israeli economy as high financial stability; a healthy, productive banking sector; a flexible economy can adopt to changes; a hi-tech industry that brings many positive attributes to the Israeli economy; being on the road of energy independence, leading to the possibility of becoming an exporter of energy in the future.

Comments powered by CComment