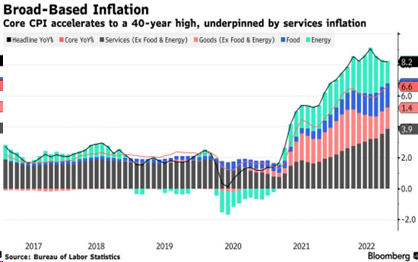

| Governments, particularly in the United States, are bragging that inflation is declining. How they measure it is the issue. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of tens of thousands of consumer goods and services. The most upbeat data we are seeing, however, refers to a Core Inflation Index that includes many consumer products and services but excludes those from the food and energy sectors. The final rate is therefore substantially lower than the CPI because the inflation rate was 10.1% in the food sector and 8.7% in the energy sector during the 12 months ending in Jan. 2023. Thus, the real impact of inflation on the underprivileged and lower middle class is concealed. |

Why inflation will be hard to bring down

(The Economist).– Financial markets are floating high on optimism. Investors are increasingly betting that inflation, the world economy’s biggest problem, will fall away without much fuss. America’s S&P 500 index has been buoyant this year, European shares even more so, and money has poured into emerging economies. But what if investors are wrong to be so cheery? (...) the battle with inflation is far from over. Six of the big, rich G7 countries enjoy an unemployment rate at or close to the lowest seen this century. It is hard to see how underlying inflation can dissipate while labour markets stay so tight (...) it would be a problem for central bankers, who are judged against their targets. And it would blow a hole in investors’ optimistic vision.

Inflation will be harder to bring down than markets think

Investors are betting on good times. The likelier prospect is turbulence.

Feb.16.– Given how woefully stock and bond portfolios have performed over the past year or so, you may not have noticed that financial markets are floating high on optimism. Yet there is no other way to describe today’s investors, who since the autumn have increasingly bet that inflation, the world economy’s biggest problem, will fall away without much fuss.

Feb.16.– Given how woefully stock and bond portfolios have performed over the past year or so, you may not have noticed that financial markets are floating high on optimism. Yet there is no other way to describe today’s investors, who since the autumn have increasingly bet that inflation, the world economy’s biggest problem, will fall away without much fuss.

The result, many think, will be cuts in interest rates towards the end of 2023, which will help the world’s major economies—and most importantly America—avoid a recession. Investors are pricing stocks for a Goldilocks economy in which companies’ profits grow healthily while the cost of capital falls.

In anticipation of this welcome turn of events, the s&p 500 index of American stocks has risen by nearly 8% since the start of the year. Companies are valued at about 18 times their forward earnings—low by post-pandemic standards, but at the high end of the range that prevailed between 2002 and 2019. And in 2024 those earnings are expected to surge by almost 10%.

(...)

[ Full text ]

Comments powered by CComment