[ Lea un análisis en Español AQUÍ ]

Bitcoin is a new "currency" created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! There are no transaction fees and no need to give your real name.

Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, Bitcoin is pretty much like cash for the Internet. Bitcoin can also be seen as the most prominent "triple entry bookkeeping" system in existence.

Triple entry is a simple idea, albeit revolutionary to accounting. A triple entry transaction is a 3 party one, in which Mary pays Tom and Ivan intermediates. Each holds the transaction, making for triple copies. To make a transaction, Mary signs over a payment instruction to Tom with her public-key-based signature. Ivan the issuer then packages the payment request into a receipt, and that receipt becomes the transaction.

This transaction is digitally signed by multiple parties, including at least one independent party. It then becomes a powerful and tangible evidence of the transaction. The final receipt *is the entry*. Then, the *collection of signed receipts* becomes the accounts, in accounting terms. This collection replaces the double entry bookkeeping system, because the single digitally signed receipt is a better evidence than the two entries that make up the transaction, and the collection of signed receipts is a better record than the entire chart of accounts.

How does one acquire bitcoins?

- As payment for goods or services.

- Purchase bitcoins at a Bitcoin exchange.

- Exchange bitcoins with someone near you.

- Earn bitcoins through competitive mining. [ see video further down ]

How does Bitcoin work?

From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. This is how Bitcoin works for most users.

Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This is often called "mining".

How are bitcoins created?

New bitcoins are generated by a competitive and decentralized process called "mining". This process involves that individuals are rewarded by the network for their services. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange.

The Bitcoin protocol is designed in such a way that new bitcoins are created at a fixed rate. This makes Bitcoin mining a very competitive business. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. No central authority or developer has any power to control or manipulate the system to increase their profits. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow.

Bitcoins are created at a decreasing and predictable rate. The number of new bitcoins created each year is automatically halved over time until bitcoin issuance halts completely with a total of 21 million bitcoins in existence. At this point, Bitcoin miners will probably be supported exclusively by numerous small transaction fees.

Anybody can become a Bitcoin miner by running software with specialized hardware. Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions. Bitcoin miners perform this work because they can earn transaction fees paid by users for faster transaction processing, and newly created bitcoins issued into existence according to a fixed formula.

Is Bitcoin legal?

Bitcoin has not been made illegal by legislation in most jurisdictions yet. However, some jurisdictions (such as Argentina and Russia) severely restrict or ban "foreign currencies". Other jurisdictions (such as Thailand) may limit the licensing of certain entities such as Bitcoin exchanges.

Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. For example, the Financial Crimes Enforcement Network (FinCEN), a bureau in the United States Treasury Department, issued non-binding guidance on how it characterizes certain activities involving virtual currencies, considering that the impersonal and unregulated Bitcoin system now prevailing is the perfect tool for money laundering. It is the perfect version of a fiscal paradise for criminal transactions. The head of this federal agency overseeing financial crimes, Jennifer Shasky Calvery, testified before Congress last November and declared that "we know that it has been exploited by some pretty serious criminal organizations". Accordingly, Congress is now beginning to look for the ways and means to regulate digital currency, including Bitcoin.

Risk and speculation

Standard currency issued by government ─like the US Dollar or the €uro─ depends on Central banks for stability. The Federal Reserve issuing monetary policy and acting as a Central bank acts to keep the value of a dollar from flying up and down like the stock market does.

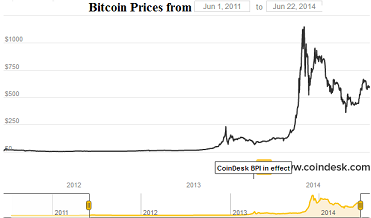

The bitcoin market is quite volatile and may shift by hundreds of dollars in a single week.

For the first three to four years of its life, bitcoin was actually fairly stable, as historical charts show (see chart below). The price increased very gradually from roughly $0.05 per bitcoin to more like $5 per bitcoin ─ a good rate of return for early investors. And that is what bitcoin holders are: “investors”. Bitcoin is a market full of speculators, and because it’s not tied to anyone’s monetary policy or oversight, it’s prone to boom and bust. Since the beginning of 2013, the value of bitcoin has jumped as high as $1116 last December and dropped to just over $500 by March this year. It is just over $600 as of today.

Investment losses or devaluation are only one of the two big ways bitcoin users can be left high or dry. The other is good old-fashioned theft. While the US money you keep at a standard bank is insured against disaster by the FDIC, there is no such backstop for bitcoin wallets. If the virtual place your virtual money is stored loses it all, you’re screwed.

Comments powered by CComment