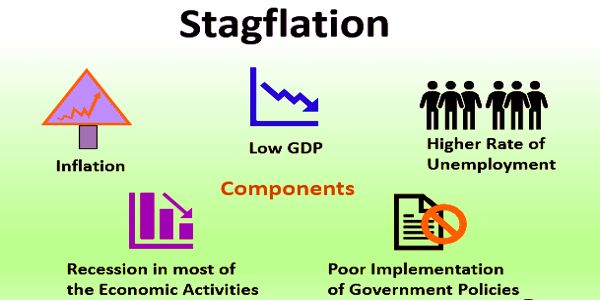

America is experiencing the sharpest price spike since the Carter Administration. The budget waste and the enormous increases in the Money Supply (M2) are causing an accelerated erosion in the value of the dollar and, therefore, in its purchasing power. This economic policy is laying the foundations for an upcoming hyperinflation that may cause the second most crippling stagflation in the country's history.

Wholesale Prices See Biggest Annual Surge on Record

Wholesale prices rose at their fastest annual pace on record in November, with the newest inflation-related datapoint adding to broader concerns about the persistence of elevated prices as higher input costs for producers tend to trickle down to consumers.

The Labor Department said in a Dec. 14 statement that, for the 12 months ending in November, the final demand producer price index (PPI) jumped by 9.6 percent, the highest number in the history of the series, which goes back to 2010. Consensus forecasts predicted a slower 9.2 percent rise in the PPI final demand measure.

On a month-over-month basis, the final demand PPI gauge rose 0.8 percent in November. While that’s lower than the record high of 1.2 percent logged in January, it represents an acceleration in wholesale prices from the prior month’s reading of 0.6 percent and a sign that inflationary pressures were once again picking up steam.

Producer prices excluding food, energy, and trade services—a gauge often preferred by economists as it excludes the most volatile components—also shot up in November compared to the prior month’s readings. On a month-over-month basis, the so-called core PPI rose 0.7 percent in November, nearly double October’s pace ...

[ Texto completo ]

Comments powered by CComment