When there is a stock market crash signaling a recession, stagflation, or severe depression, what we are experiencing is a sudden and very large drop in the value of stocks in the markets, causing a hasty sale of stocks and other securities by investors and some institutions. When the underlying value of the companies that issue the shares suddenly collapses, their price also falls proportionally and the resulting situation is the loss of much of the money that people invested and, in extreme cases, as in the Great Depression of last century, the loss of all your invested capital.

When there is a stock market crash signaling a recession, stagflation, or severe depression, what we are experiencing is a sudden and very large drop in the value of stocks in the markets, causing a hasty sale of stocks and other securities by investors and some institutions. When the underlying value of the companies that issue the shares suddenly collapses, their price also falls proportionally and the resulting situation is the loss of much of the money that people invested and, in extreme cases, as in the Great Depression of last century, the loss of all your invested capital.

The hackneyed argument of the stock market as a capitalist den of speculators and millionaires is false. The indisputable reality is that there are countless small investors who have accumulated their life savings and invested them in stocks and that almost all citizens who have worked in the country have their pension funds invested in mutual funds and securities that pay substantial interest or dividends or in investment programs known as 401(k) that exempt them from taxes.

The serious problem for those who depend on these investments to have an additional income or a decent pension is when a market collapse occurs precisely when they have to sell some of these securities to cover unforeseen expenses or when their pension income is barely enough to cover essential expenses of their monthly budget.

What Causes a Stock Market Crash?

A stock market crash is caused by two circumstances: a dramatic drop in stock prices and the resulting panic. Here's how it works: Each of the shares owned represents a small stake in a company, and the investors who buy them make a profit when the value of their shares increases or when they receive interest or dividends approved by the company's board of directors. The price of these shares depends on the opinion of the majority of investors at that time about the value and future prospects of that company. So if they think the company they're investing in is headed for tough times, they sell those stocks in an attempt to exit before their value falls.

The reality is that panic plays as much (or more) a role in a stock market crash than the actual economic problems that cause it. There is an obsessive reaction that irrationally drives scores of investors to dump their shares at whatever price they can get, and the market plunges into a full-blown crash.

Most of us have already experienced two major market downturns:

The Great Recession of 2009

The Dow Jones Industrial Average (DJIA) lost more than 50% of its value in a very short time. But seven years later the market began to recover at an accelerating rate and was stronger than ever for the next three years: basically, there was a bull market (a period of great economic growth) from 2016 until just before the collapse of the coronavirus.

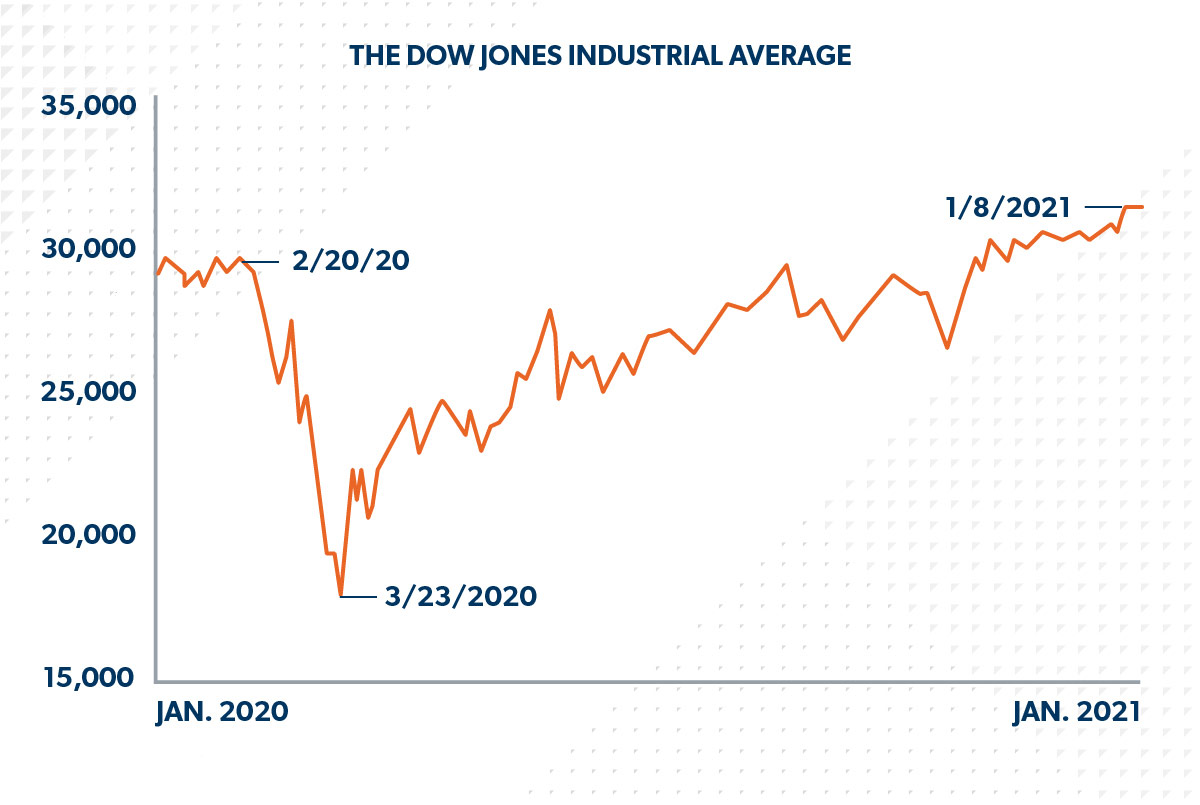

The collapse of the coronavirus in 2020

In March 2020, the COVID-19 pandemic triggered the fastest global collapse in financial history. Even so, the stock market started to recover quite quickly during the second half of the same year and the year closed with all-time highs again: On December 31, 2020, the stock market had made up all the lost ground, and then some!

What can we learn from past recessions to help right now?

There are several latent signals today that are often decisive for a stock market crash to occur:

- Covid-19: the coronavirus is going nowhere and the new strains are causing the number of cases of infected and dead to increase.

- Unemployment: Although millions of jobs have been recovered since the country was hit hard early in 2020, we continue to experience huge unemployment figures signaling a fragile economy.

- Inflation: Those stimulus checks have been a handout that does not solve the problem, and they come at such a huge cost that it is already causing serious consequences. With such excessive government spending, we have seen an increase in inflation that already exceeds 5% and aims to reach between 7% and 9% by next Spring, which has led investors to back away fearfully on what so far has only been a slight decline in the stock market.

If the market collapses again in 2021/2022, we must remember that the other drop from last year is too close. In the midst of chaos, we must focus on what we can control: our attitude, to make it rational; our prospects for a future recovery that will prevent panic; and our decisions based on our needs and not on speculative moves. Of course, a collapse of the stock market and its consequent recession or depression causes the fear of being left helpless and homeless on the street. Therefore, some changes will have to be made: 1) we have to resist the tendency to panic avoiding any blind sell-out of our assets, unless the money is needed to pay off debts and essential needs; 2) we have to cut our budget, especially on non-essential expenses and focus on maintaining the budget for food, utilities, housing and transportation; and, 3) if we are contributing a portion of our income to cover future needs and/or for our retirement, we must make every effort to continue contributing/investing at the same rate as before.

It is essential to choose to be patient and think long term to face these circumstances. It doesn't matter what the rest of 2021/2022 has in store for us but instead let's remember what we know from experience to be true. Quite simply, we care about our family, our dreams, and our future – our investment decisions should be made with those things in mind. We will survive the worst of economic collapses if we maintain a positive attitude to focus only on the factors that we can control.

And, remember, this applies to any country under similar circumstances.