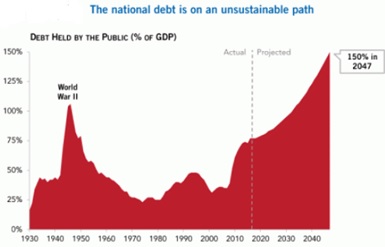

Despite an adversarial Congress that suffers from a wasteful budgetary tendency, the US National Debt had been slowing down during the Republican Administration of President Trump during his first three years in power; not much, but better than the fast increasing rate under President Obama, who duplicated in only eight years the National Debt inherited from President Busch. However, the National Debt has been exploding again since the outburst of the Covid-19 pandemic.

It is evident that President Trump has been giving-in to the pressure of public opinion, notably orchestrated by the Democratic Party, complying with and promoting measures that contribute to an already unsustainable expansion of that debt, while a practically closed economy worsens every day the tragic economic situation that is developing and that will have inescapable serious consequences of unemployment, deterioration of purchasing  power and acute general impoverishment of the population.

power and acute general impoverishment of the population.

But what is the national debt? How is it accounted for in the United States? What we know about obligations and costs?

The US National Debt is counted as all of the debt owed by the national government, based in Washington D.C. But did you know that debts owed by state and municipal governments are not included in those figures? They are huge as well. But let us concentrate on the National Debt issue.

So far, in spite of the huge US National Debt, the ratio of national debt to Gross Domestic Product (GDP) is still smaller for the United States than for 15 other countries: Japan, Greece, Sudan, Venezuela, Lebanon, Italy, Eritrea, Barbados, Yemen, Cabo Verde, Portugal, Gambia, Republic of Congo, Singapore and Mozambique, in that order. Observe that with the exception of Japan, and somehow with the exception of Italy and Singapur as well, the other 12 countries are mostly underdeveloped and mismanaged.

In fact, all those countries either experience a real economic and financial crisis, or a recession, or generalized poverty. Therefore, the US National Debt is in fact a very serious problem.

US government debt is the responsibility of the Treasury Department. Money is raised in the form of bonds, which are known as “Treasury bonds,” “Treasury bills,” or “T-bills.” These Bonds are sold in auctions, which are conducted by the Federal Financing Bank and each sale event can raise a maximum of US$15 billion.

The US National Debt is subdivided into two sections. These are defined as “debt held by the public” (bonds and other obligations) and “intragovernmental holdings.” The IMF figure for the US Debt to GDP ratio of 108% includes both of these figures. That means that the humongous 26,5 trillion US Debt is 8% higher that the entire production and services of the United States at all levels of the economy for a whole year. Social Security is part of this "intragovernmental" debt, because contributions are not kept in a separate fund (as some pension systems do), but the program's retirement and disability trust funds together held more than $2.9 trillion in special non-traded Treasury securities, or 13.3% of the total debt. To this we must add the personal debt accumulated by each citizen for a US total of almost $21 trillion.

It is important to consider as well that "Intragovernmental holdings" include the nation’s obligations to pay pensions and disability benefit to ex-government employees. This fund is held in trust and is called the Civil Service Retirement and Disability Fund (CSRDF). The assets of this fund are Treasury bonds (pure contracts that must be paid when due, including interest), which is how this pension obligation gets accounted for as part of the national debt.

In order to understand the meaning of this overwhelming National Debt, it is necessary to analyze some illuminating aspects and the resulting obligations:

Interest Payments per Year $211,576,000,000

Interest Payments per Second

$6,709 !!!

National Debt per Citizen

$80,699

National Debt per Taxpayer

$213,899

You could wrap $1 bills around the Earth 103,037 times with the debt amount. If you lay $1 bills on top of each other they would make a pile 2,890,720 km, or 1,796,210 miles high. That's equivalent to 7.52 trips to the Moon.

That is what US tax contributors would have to pay sooner or later if the country does not collapse before declaring default and bankruptcy. A national bankruptcy and/or another Great Depression are real possibilities if budgetary policies are not corrected soon during this coming decade.